New Homebuyer Series: What Is Credit and Why Is It Important

What is credit?

Credit is simply money that is extended to you with an agreement to pay that money back in the future. Obviously, this often comes with interest, which is the creditor’s way of making their money work for them. It is the fee you pay for the use of the money. There is usually a level of risk involved and comes with some sort of collateral that is built into the terms that you agree to.

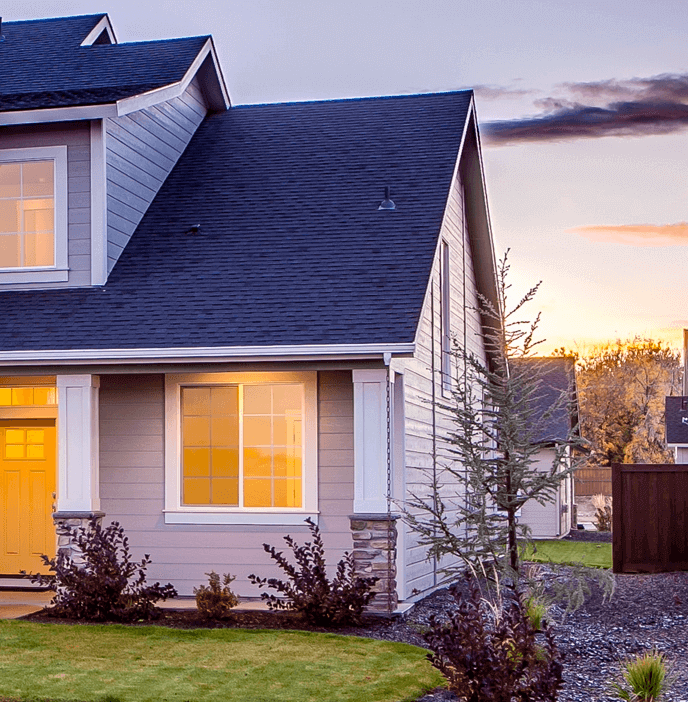

In our case, that would be a house. The house is what the lender will receive, should you default on the loan and be unable to make payments. This is called a foreclosure and it ensures that the bank has recourse should something happen to sever the terms of the loan.

Why is it important?

Having credit is important because it allows you to utilize the funds to invest financially in your future. Often that money you are using is to invest in a house, which will reward you with equity at some point in the future. A home is an investment. Without the use of credit, you would not be able to invest in these types of assets until you had saved that amount of money, which is an unrealistic or incredibly long term expectation. It could take you years to accumulate enough funds to purchase a house, so getting a mortgage can be one of the best things to do as it allows you to invest and grow now, instead of waiting for years down the line.

Good credit is important because it can drastically affect the rates and terms of your loan. Having a higher credit score could allow you to secure a lower rate of interest, which will end up saving you money in the long run, or it may assist you in using a smaller down payment. Having good credit is an invaluable tool when it comes to your financial future, especially as it pertains to the purchase of a home!

We hope that this post gives you some insight into the process of what credit is and why it’s important to manage it. If you have any questions or would like to start the process of looking for a home, reach out to us and apply on our website to be connected with one of our loan specialists!